MI DC 102c 2019-2026 free printable template

Show details

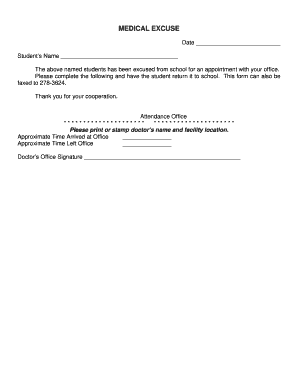

Form DC 102c COMPLAINT TO RECOVER POSSESSION OF PROPERTY Use this form if you want to recover possession of real property. Complaint is made and judgment is sought for money damages against the defendant as follows Use a separate sheet of paper if needed. Date DC 102c 12/19 COMPLAINT TO RECOVER POSSESSION OF PROPERTY MCL 600. Original - Court 1st copy - Tenant Approved SCAO STATE OF MICHIGAN JUDICIAL DISTRICT A 2nd copy - Mailing 3rd copy - Landlord Court address B CASE NO. Court telephone...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dc 102c form

Edit your dc102c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form possession michigan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit michigan form dc 102c online

To use the professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit michigan eviction forms. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DC 102c Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out complaint to recover possession of property michigan form

How to fill out MI DC 102c

01

Gather all necessary personal information including your name, address, and contact details.

02

Provide the date of birth and social security number as required.

03

Indicate the type of application or request you are submitting.

04

Complete the specific sections based on your situation (e.g., income information, reason for application).

05

Review the instructions for any additional documentation that may be required.

06

Sign and date the form to confirm the information provided is accurate.

07

Submit the completed form according to the specified submission guidelines.

Who needs MI DC 102c?

01

Individuals applying for financial assistance or specific government services in Michigan.

02

Residents needing to report changes in their financial situation.

03

Those seeking eligibility for various benefit programs offered by the State of Michigan.

Fill

complaint dc 102c

: Try Risk Free

People Also Ask about form dc 102c

What needs to be sent with Michigan tax return?

Michigan Schedules and Forms (e.g. Schedule W, Schedule 1, Form 4884, MI-1040CR) Federal amended return and schedules. Copies of the Internal Revenue Service (IRS) audit report, notice, federal transcripts or other supporting documents. Property tax statements/lease agreements.

What are the 3 basic forms used to file income taxes?

About Form 1040, U.S. Individual Income Tax Return Schedule 1 (Form 1040) Additional Income and Adjustments to Income. USE IF Schedule 2 (Form 1040), Additional Taxes. USE IF Schedule 3 (Form 1040), Additional Credits and Payments. USE IF …

What is the path program in Michigan?

(PATH) program helps participants transition off public assistance to obtain and maintain employment, earn wages and develop self-sustainability. PATH is a partnership between Workforce Development (WD), the Michigan Department of Health and Human Services (MDHHS), and Michigan Works! Agencies (MWAs).

Do you have to attach W-2 to Michigan state tax return?

Start with your completed U.S. 1040-NR. You will also need any W-2, 1042-S, or 1099 forms that you received for 2020. 2.

Do you have to include W-2 with tax return?

You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. You don't need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.

How do I apply for DHS in Michigan?

The most efficient way to determine eligibility is to apply online using the Michigan Bridges online application portal. To view, print or complete a paper application, download the DHS Information Booklet. Application(s) may be hand delivered, mailed or faxed to the local DHS office.

What is the difference between a 1040 and 1099?

The key difference between these forms is that Form 1040 calculates your tax or refund. It includes multiple details about your personal tax situation. Forms 1099 report only one source of income.

What documents do I need file my taxes?

What documents do I need to file my taxes? Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations. Tax deduction records. Expense receipts.

Who has to file an MI-1040?

You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W. For more information on part-year residency view the MI-1040 instruction booklet .

How to apply for dhs car voucher Michigan?

The best way to apply for assistance is online using MI Bridges. If you need to use this paper application, keep in mind that you'll need to print and complete the application, and then take it to your local MDHHS office.

Do I need to include W-2 with Michigan tax return?

Any W-2 that indicates Michigan withholding must be filed with Treasury, regardless of residency status. Treasury requires state copies of the following W-2s: W-2, when issued to an employee for work performed in Michigan or to report Michigan income tax withheld.

Does Michigan file state taxes?

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax. Select the tax year link desired to display the list of forms available to download.

Does Michigan have a state tax ID?

Banks, government entities, and companies can use your Michigan tax ID number to identify your business. A Michigan tax ID number is a requirement for all businesses in the state of Michigan. Before you can request a Michigan tax ID number for your business, you will need to acquire an EIN from the IRS.

Does Michigan DHS help with a car?

THE MAXIMUM AMOUNT WE PROVIDE IS $3000.00 TO GO TOWARDS THE PURCHASE OF A CAR.

What is a Michigan 1040 form?

2021 Michigan Individual Income Tax Return MI-1040.

Does Michigan have a state tax form?

The most common Michigan income tax form is the MI-1040. This form is used by Michigan residents who file an individual income tax return.

Where can I find Michigan state tax forms?

In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

What forms do I need to file Michigan taxes?

Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR, and Schedule W.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit how to fill out mi to the specified submission guidelines from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your 102c into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send dc 102 for eSignature?

To distribute your dc102, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit complaint to recover possession of property on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign obtain forms on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is MI DC 102c?

MI DC 102c is a specific form used in the state of Michigan for reporting certain tax information to the state tax authorities.

Who is required to file MI DC 102c?

Individuals or businesses that meet specific criteria related to tax liability and income in Michigan are required to file MI DC 102c.

How to fill out MI DC 102c?

To fill out MI DC 102c, you need to provide your personal or business information, income details, and other supporting documentation as required by the state.

What is the purpose of MI DC 102c?

The purpose of MI DC 102c is to report certain income and tax information to the Michigan Department of Treasury for compliance and assessment of tax obligations.

What information must be reported on MI DC 102c?

Information that must be reported on MI DC 102c includes the taxpayer's name, address, identification number, and specific income sources along with any applicable deductions or credits.

Fill out your MI DC 102c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice To Recover Possession Of Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.